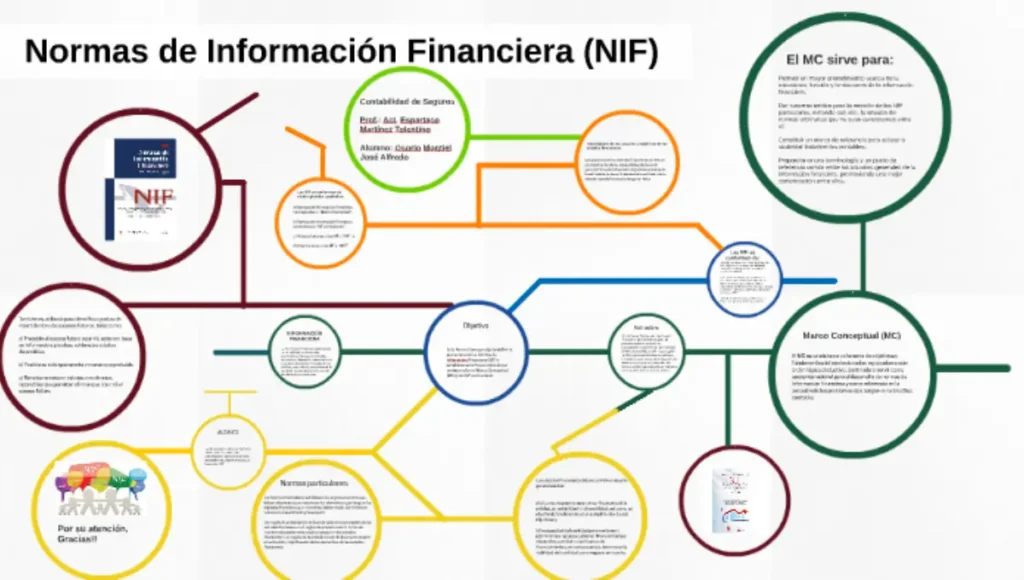

Navigating the intricate realm of financial affairs demands strict adherence to standardized reporting and accounting protocols. This discourse delves profoundly into the labyrinthine domain of “Normas de Información Financiera ” (NIF), the Mexican Financial Reporting Standards. We aim to furnish you with an exhaustive comprehension of their paramount import, practical application, and the profound resonance they wield within the sphere of financial reporting.

“What are Normas de Información Financiera Standards (NIF)?

Financial professionals, for instance, face the challenge of staying updated onNormas de Información Financiera (NIF).

NIFs serve to structure accounting theory and enable the establishment of boundaries while providing a regulatory framework for the presentation and issuance of financial information.

Furthermore, they simplify the process of interpretation for users of this information, such as companies, financial institutions, or public entities.

Mastering this topic enhances your prospects of securing a better professional position. Hence, in this article, you will learn about what financial standards are.”

Why are NIFs Important?

First and foremost, it’s crucial to grasp that NIFs (Normas de Información Financiera ) are a set of comprehensive and specific regulations designed to elucidate how financial information is presented in financial statements over a specified period.

The governance of NIFs falls under the purview of the CINIF (Mexican Council for the Investigation and Development of Normas de Información Financiera ).

This institution is responsible for promulgating regulations in a lucid, objective, reliable, and transparent manner within Mexico.

The significance of NIFs lies in their ability to provide structure and clarity to financial information, given its dynamic and ever-changing nature. They also establish boundaries and conditions for the operation of accounting information.

The primary aim when implementing NIFs is to generate financial information that is comparable, transparent, and of high quality, serving the objectives of those who rely on this information.

Understanding NIFs

Categorizing NIFs

To delve deeper into the subject, it’s imperative to comprehend that Normas de Información Financiera NIFs are categorized into series, as per the Mexican Council of Financial Information Standards, and within these series, we find information about each category of financial statements.

Series NIF A

This series elucidates the structure of Normas de Información Financiera, fundamental organization, objectives, and information presented in financial statements.

- NIF A-1 Structure of Financial Information Standards.

- NIF A-2 Basic Postulates.

- NIF A-3 User Needs and Objectives of Financial Statements.

- NIF A-4 Qualitative Characteristics of Financial Statements.

- NIF A-5 Fundamental Elements of Financial Statements.

- NIF A-6 Recognition and Valuation.

- NIF A-7 Presentation and Disclosure.

- NIF A-8 Supplementation.

- BC Basis for Conclusions of the Conceptual Framework.

- cta-how-to-grow-your-business-with-gifs

Series NIF B

Within this series, you’ll discover information regarding the rules for Normas de Información Financiera, methodology, preparation, presentation, and disclosure applicable to financial statements as a whole.

- NIF B-1 Accounting Changes and Error Corrections.

- NIF B-2 Statement of Cash Flows.

- NIF B-3 Statement of Comprehensive Income.

- NIF B-4 Statement of Changes in Equity.

- NIF B-5 Segment Reporting.

- NIF B-6 Statement of Financial Position.

- NIF B-7 Business Combinations.

- NIF B-8 Consolidated or Combined Financial Statements.

- NIF B-9 Interim Financial Information.

- NIF B-10 Effects of Inflation.

- NIF B-12 Financial Assets and Financial Liabilities Offset.

- NIF B-13 Events After the End of the Reporting Period.

- B-14 Earnings per Share Jan. 1997.

- NIF B-15 Foreign Currency Translation.

- NIF B-16 Financial Statements of Entities with Non-profit Purposes.

- NIF B-17 Fair Value Determination.

Series NIF C

This series establishes Normas de Información Financiera valuation, presentation, and disclosure standards for these concepts in financial statements.

- NIF C-1 Cash and Cash Equivalents.

- NIF C-2 Investment in Financial Instruments.

- NIF C-3 Accounts Receivable.

- NIF C-4 Inventories.

- NIF C-5 Prepayments.

- NIF C-6 Property, Plant, and Equipment.

- NIF C-7 Investments in Associates, Joint Ventures, and Other Permanent Investments.

- NIF C-8 Intangible Assets.

- NIF C-9 Provisions, Contingencies, and Commitments.

- NIF C-10 Derivative Financial Instruments and Hedging Relationships.

- NIF C-11 Equity.

- NIF C-12 Financial Instruments with Characteristics of Liabilities and Equity.

- NIF C-13 Related Parties.

- NIF C-14 Transfer and Disposal of Financial Assets.

- C-15 Impairment of Long-term Asset Value and Disposition.

- NIF C-16 Impairment of Receivables.

- NIF C-18 Obligations Related to the Retirement of Property, Plant, and Equipment.

- NIF C-19 Financial Instruments Payable.

- NIF C-20 Financial Instruments Receivable for Principal and Interest.

- NIF C-21 Agreements with Joint Control.

- CTA – FREE COURSE 1

Series NIF D

These standards pertain to issues of result determination.

- NIF D-1 Revenue from Contracts with Customers.

- NIF D-2 Costs from Contracts with Customers.

- NIF D-3 Employee Benefits.

- NIF D-4 Income Taxes.

- D-5 Leases.

- NIF D-5 Leases.

- NIF D-6 Capitalization of Comprehensive Financing Income.

- NIF D-8 Equity-settled Share-based Payment Transactions.

Series NIF E

These standards apply to specialized activities across various sectors.

E-1 Agriculture (Agropecuniary Activities).

NIF E-2 Donations Received or Granted by Non-profit Entities.

Circulars.

Circulars provide guidance, clarifications, or recommendations on the standards.

INIF 3 Initial Application of NIFs.

INIF 17 Service Concession Agreements.

INIF 19 Change Resulting from the Adoption of International Financial Reporting Standards.

INIF 20 Accounting Effects of the 2014 Tax Reform.

INIF 21 Recognition of Employee Separation Payments.

Interpretations of Financial Information Standards NIF.

INIF 3 Initial Application of NIFs.

INIF 9 Presentation of Comparative Financial Statements upon Implementation of NIF B-10.

INIF 14 Construction, Sale, and Provision of Services Related to Real Estate Contracts.

INIF 15 Financial Statements with Reporting Currency Equal to but Different from Functional Currency.

INIF 17 Service Concession Agreements.

INIF 19 Change Resulting from the Adoption of International Financial Reporting Standards.

INIF 20 Accounting Effects of the 2014 Tax Reform.

INIF 21 Recognition of Employee Separation Payments.

Guidance on Financial Information Standards, also known as NIF.

ONIF 3 Synopsis of Regulations on Financial Instruments.

Glossary.

List of Members of the Accounting Principles Commission.

As you can observe, there exists a Normas de Información Financiera significant array of ever-evolving standards that necessitate staying abreast of developments for outstanding professional performance.

Currently, both online and in-person courses are available through which you can gain comprehensive insights into the evolving financial regulations.

Read More:

Understanding Normas de Información Financiera: A Comprehensive Guide