Are you dreaming of hitting the road in a new car but worried about the lengthy and complicated process of getting auto financing? Don’t fret! This detailed guide will go into the realm of right-away auto loans, where you can swiftly and effectively obtain car financing that is Instant Auto Finance. It is a modern and efficient way of securing car financing swiftly and conveniently. It will simplify the standard application procedure for auto loans, enabling people to finance their vehicle purchases virtually immediately. This method does away with the necessity for protracted waiting times and copious documentation, allowing automobile buyers to leave with their selected vehicles more quickly.

It typically involves online lenders, dealerships, or financial institutions that offer quick approval decisions.

let’s start!

Table of Contents

- Introduction to Instant Auto Finance

- The Benefits of Instant Auto Finance

- How Does Instant Auto Finance Work?

- Eligibility Criteria for Instant Auto Finance

- Tips for a Successful Instant Auto Finance Application

Introduction to Instant Auto Finance

- What Is Instant Auto Finance?

It refers to a streamlined and efficient process of obtaining car financing, often with quick approval decisions. It’s designed to eliminate the hassle and delays associated with traditional auto loan applications, allowing you to secure financing rapidly.

- Why Choose Instant Auto Finance?

Discover the advantages of opting for it and why it might be the ideal choice for your car-buying journey.

The Benefits of Instant Auto Finance

- Speedy Approval:

One of its defining characteristics is the rapid approval process. Applicants can often receive a decision within minutes or hours, as opposed to the days or weeks it may take with traditional auto loans.

- Online Accessibility:

Due to its online availability, candidates can finish the full procedure while relaxing in their homes. This online ease improves accessibility and does away with having to visit financial institutions in person.

- Simplified Application:

The process for applying is made to be simple and easy to use. Through an online form, applicants give important details such as their personal information, proof of income, and the requested loan amount.

- Flexible Options:

It also offers flexibility in terms of vehicle selection. Borrowers can look into multiple options within their budget by selecting from a large selection of new and used cars.

- Enhanced Negotiation Power:

Another advantage of it is that approved applicants are often viewed as cash buyers by dealerships. This status can improve negotiation power and potentially lead to more favorable terms during the vehicle purchase process.

How Does Instant Auto Finance Work?

- Online Lenders and Dealerships

Understand where to find lenders and dealerships offering it and how to get started online.

- The pre-approval procedure

Learn more about the preapproval procedure and how it can make it easy for you to understand your finances and your financing alternatives.

- Loan Terms and Interest Rates

Explore the factors that influence loan terms and interest rates.

- Required Documentation

Find out what documents you’ll need to provide during the auto finance application process.

Eligibility Criteria for Instant Auto Finance

- Credit Score Requirements

Understand the role of your credit score and how it affects your eligibility for auto finance.

- Income Verification

Learn how lenders assess your income and employment history to determine eligibility.

- Down Payment Options

Explore the possibilities of down payment requirements and how they can impact your financing.

- Co-Signer Considerations

Discover whether having a co-signer can improve your chances of approval.

Tips for a Successful Instant Auto Finance Application

- Check Your Credit Report

Learn why reviewing your credit report is essential before applying for this finance.

- Determine Your Budget

Learn how to create a budget that supports your financial objectives.

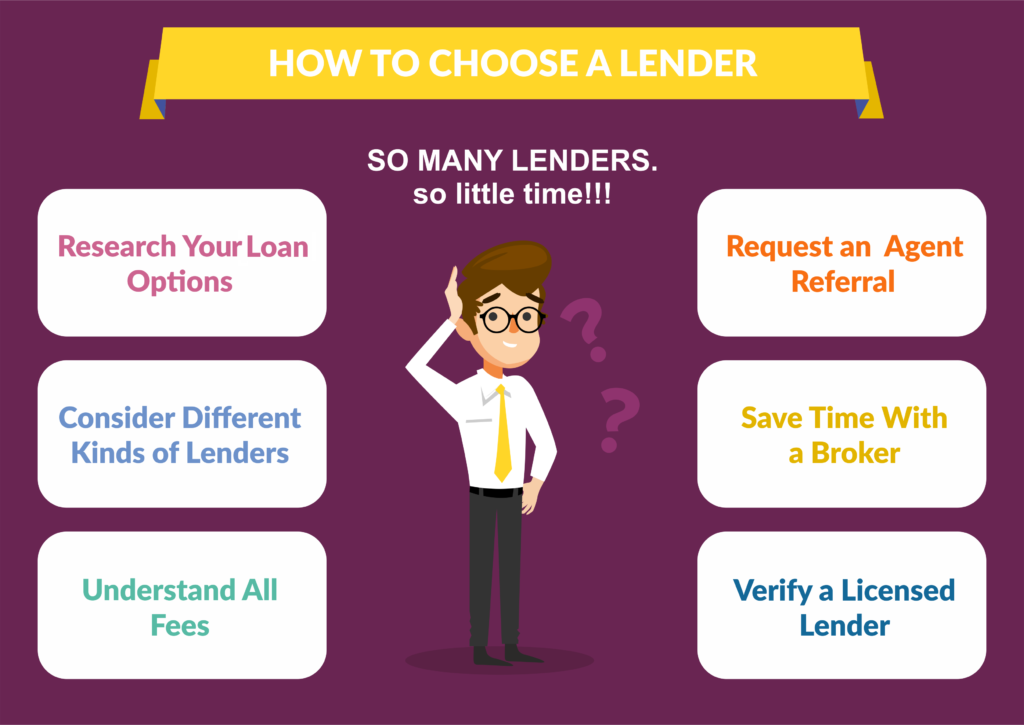

- Compare Lenders and Dealerships

Explore the importance of shopping around and comparing offers from different providers.

- Read the Fine Print

Realize the significance of carefully reading your quick auto finance agreement’s terms and conditions.

FAQs

1 What Is the Difference Between Traditional and Instant Auto Finance?

Get insights into the distinctions between traditional and instant auto finance.

2 Can I Get Instant Auto Finance with Bad Credit?

Learn about the possibilities of securing instant auto finance even if you have a less-than-perfect credit history.

3 Is a Down Payment Required for Instant Auto Finance?

Discover whether a down payment is necessary and how it can affect your financing options.

4 How Do Interest Rates Work in Instant Auto Finance?

Understand how interest rates are determined and their impact on your monthly payments.

5 What Happens After I’m Approved for Instant Auto Finance?

Learn about the next steps once you’ve been approved for instant auto finance and how to finalize your car purchase.

Conclusion

Summarize the key takeaways from this guide and prepare for a smooth and efficient car financing journey with instant finance.

Get ready to hit the road in your dream car without the wait. Auto finance is your ticket to a swift and hassle-free car financing experience. If you want to finance your automobile quickly and easily, an instant auto loan has grown to be a popular option. It enables people to get behind the wheel of their dream cars with the smallest amount of waiting time instead of the longer and more cumbersome traditional auto loan process. Join me as we set off on this quest!

See more: